Giant state-owned aluminium group Chalco has been exposed as a large-scale polluter in China, yet praised as a model of environmentally diligent overseas investment in Peru. Environmental experts told chinadialogue that such stark differences in the performance of one company rest on differences in legislation and enforcement in the countries it operates in.

However, the success of Chalco’s copper mining operations in Peru shows that, after a difficult period of acclimatisation, Chinese firms are now able to deal with environmental concerns thoroughly and swiftly.

During Chinese president Xi Jinping’s July tour of Latin America, the Peruvian ambassador to China, Mr Gonzalo Gutierrez, praised Chalco as a model for overseas investment, citing its high environmental standards and sense of social responsibility: “I hope this will set an example for investors from China and elsewhere.”

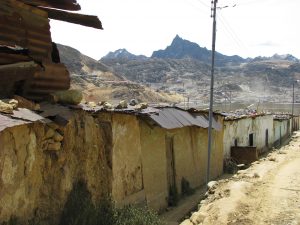

The praise was hard-earned, representing more than mere routine flattery of a major investor. Chalco purchased Peru Copper in 2007, acquiring the hugeToromocho copper mine on the Altiplano plateau. It paid to move an entire town of 5,000 people to a safer site five miles away from toxic waste dumps left by Peru Copper, and spent heavily on environmental assessments. Toromocho mine boasts 12 million tonnes of copper — 19% of China’s total domestic copper deposits, according to Xinhua.

But at home Chalco has been exposed as a large-scale polluter, with Xinhua having reported on more than one case.

It is an investor in Guangxi Huayin Aluminium, where a sludge storage pond leaked. Locals in the southwestern province complained the leak forced them out of their homes, made water undrinkable and prevented planting of crops. Clean-up after the latest incident cost in excess of 8 million yuan, while Huayin was fined only 100,000 yuan. Similar cases have occurred in Chalco subsidies in Shanxi and Lanzhou in north China.

Local enforcement holds the key

The discrepancy has left China’s environmentalists wondering how to close the gap. Wang Canfa, a professor at the China University of Politics and Law (CUPL), told chinadialogue that “the legislation and enforcement of the host nation determines how seriously companies treat environmental protection.” Although all companies prefer profit over loss, they will not dare break strict laws, strictly enforced, he adds. But China currently invests mostly in developing nations where environmental laws are lacking and corruption may be a problem. The result: some Chinese firms ignore environmental issues, as they do at home. There are similar examples of foreign companies investing in China and breaking the law, says Wang.

In his view, Peru has good environmental laws and enforces them so Chalco does not take chances there. But in China, where enforcement is lax, some major firms find ways to avoid regulation and shirk responsibility for pollution. Although China has strict laws, they are selectively enforced and commonly broken.

How strongly environmental laws are enforced in in the host nation will determine a company’s environmental performance, says Liu Xiang, head of litigation at the CUPL-based Center for Legal Assistance to Pollution Victims.

China’s recently revised environmental protection law is its toughest yet – but it was already tough, just not adequately enforced, says Liu. Companies have usually been able to pay small fines if they were caught polluting, and closures have been rare. However, there are promising signs of tighter enforcement.

Tougher stance

In June, the Ministry of Environmental Protection (MEP) handed out its biggest fines yet, with 19 firms fined a total of 410 million yuan for not properly using sulphur scrubbing equipment. Those punished included two huge power generation groups, Huadian and Datang. Fines covered the cost of electricity saved by scrimping on scrubbers, and compensation for the resulting pollution. But there is no word on what follow-up action the MEP is taking, and the response from some companies has been sluggish. Huadian Group promised to make quick changes, but did not specify what they would be. Datang Group said it was unclear about the actual situation.

Despite Chalco’s cautious approach in Peru, a toxic spillage in March lead the authorities to order a halt to production. Chalco quickly upgraded its environmental protection equipment, and back in operation two weeks later. Chalco initially said the incident was not serious; Chinese media site People.com.cn described it as “relatively minor.”

The Peruvian environmental authorities disagreed. The head of the Peruvian environmental monitoring bureau’s supervision and investigation office, Delia Morales told Xinhua that the problem identified was a serious environmental protection issue. Investigators found that Chalco had not installed the required waste water collection and treatment systems. Ms Morales explained that the bureau found strongly acidic liquids in two waste stores, with pH values of 4.8 and 3.25. Those liquids were being discharged into two nearby lakes, one in a wildlife reserve.

Ma Jun, director of the Institute for Public and Environmental Affairs (IPE), told chinadialogue that the IPE’s pollution database includes a number of records of homegrown pollution by Chalco. He hopes to see the company apply its overseas approach and clean up its record.

IPE’s pollution database shows the most recent incident for Chalco was on June 10, 2014: A judgment against Chalco Zhongzhou Mining found the company had started operations at a mine without obtaining the necessary environmental approvals.

The IPE’s data allows the public to check records of pollution by almost 100,000 Chinese companies. If those firms want to be removed they must first clean up their act and meet environmental standards.

According to Ma, the poor environmental performance of Chinese firms at home is due to weak enforcement by the authorities; the difficulties of bringing lawsuits; and protection by local governments who share the firm’s interests. But he added that Chalco’s success in Peru showed that after a period of setbacks, learning and acclimatisation Chinese companies are becoming better at dealing with environmental issues.

Enlightened self-interest

As to what can be learned from Chalco’s success, Liu told chinadialogue he had never heard of a Chinese company spending so much time and money on environmental impact assessment: “Chalco spent $10 million, perhaps more than was spent on environmental impact assessment for the Three Gorges Dam.” A specialist team spent two years on the assessment, said Ren Peng, project coordinator at the Global Environment Institute (GEI).

Ruben Gonzalez-Vincente, an assistant professor at the City University of Hong Kong’s Department of Asian and International Studies who studies the overseas operations of Chinese mining firms, confirmed that the standards of Chalco’s environmental impact assessment were the highest of any Peruvian mining firm.

According to a report from the China Business News, Chalco went through an almost tortuous process to get the go-ahead for the project: government approval alone required the obtaining of over 270 separate permits from local authorities, including environmental and social impact reports.

Liu Xiang said that many of the cases of environmental litigation he has dealt with are caused by failures in the environmental assessment process. Companies do not want to suffer from environmental incidents, and often those cases are not the fault of the company itself: “Many problems can be avoided if the environmental impact assessments are done properly in the first place,” he says.

Ma Jun thinks that in China companies regard such assessments as a waste of time and money which will reduce their return on investment. So the system has inherent failings and reports are often faked.

Jin Jiaman, director of GEI, said that in China environmental impact assessments are carried out for appearance’s sake only, or simply not carried out and small fines incurred as a result. But overseas any problem with the assessment can result in the project being halted and the company incurring huge losses, so Chalco spent heavily rather than take any chances.

Wang believes such as Chalco that do well overseas should import their practices back to China. “But so far there are no successful examples of that happening.” Wang added that with China’s enforcement of environmental rules strengthening, companies should also use China’s latest standards in nations with poor environmental laws. And environmental laws in developing nations are getting tougher – if firms work to higher standards initially they won’t be left behind when the law catches up.