Being China’s grain basket can have its problems, as Brazil has recently been discovering. The South American giant’s infrastructure is creaking under the pressure of meeting Chinese demand, and it is beginning to witness the dangers of failing to deliver what the Chinese require.

Soaring Chinese demand for agricultural commodities over the past two decades has led China to look outwards to secure its needs. In 1995, China was producing and consuming 14 million tons of soybeans. In 2011, it was still producing 14 million tons of soybeans but it was consuming 70 million tons, meaning that 56 million tons had to be imported.

A significant proportion of that has come from Brazil, which is responsible for 27% of the global harvest. This year saw a record harvest of 83 million tonnes. The growth in Brazilian soy production has had serious environmental impacts over the past twenty years. Speaking to chinadialogue, Professor Carlos Reboratti said:

‘There are two major affects of the expansion of soya. Firstly the degrading of the ground as a result of monoculture and secondly the indirect affect of deforestation to increase the soy harvest. The first has to do with the price advantages of soya that means that producers always choose it over other grains. The pace of deforestation for soya has certainly reduced in recent years, if not ceased completely.

Can Brazil cope?

A new threat in addition to environmental damage is that Brazil’s infrastructure will collapse under the pressure of exporting so much soya and other agricultural products. As

Ticiane Rossi reported for the La Gran Época, Brazil is not benefiting from its increasing harvests.

‘According to a survey carried out by the Brazilian state Company of the National Subministry of Food, the fields dedicated to soya production have grown 10.4% compared to last year. The same study nevertheless showed a decline in exports compared to previous years owing to logistical limitations.’

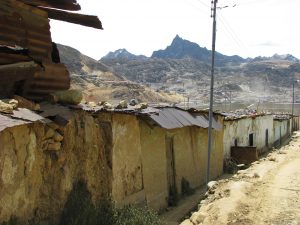

Exports have fallen and transport costs have risen largely because the roads leading to the ports are overflowing with an unprecedented volume of haulage trucks. The queues at the port of Santos often exceed 30 kilometres, with drivers having to wait over 24 hours in near stationary traffic.

Writing in the

Argentinian newspaper La Nacion, the commentator Emiliano Galli has said that the situation has put Brazil at a crucial point in its history.

Brazil is at a crossroads: its logistical collapse, a product of its growth is now threatening that very growth itself. In the short term, the kilometres long queues of trucks to the ports, and the weeks of wait to load the ships, will continue to be the most poignant image of the “other Brazil”.

Gustavo Segre, of the Consulting Group Centre…estimates that if the country grows by 5% in two years, the logistical system will completely collapse. ‘The logistical cost of the lack of infrastructure is more than US$ 9.2 billion per year and represents 10.6% of GDP’, he says.

The Brazilian government has planned US$ 100 billion of investment in a 30-year plan that considers opening up to the private sector to help modernise its roads, railways and ports. But the Brazilian Company of Planning and infrastructure, created by the government in 2012, thinks the country will need double that.

In the meantime, Brazil risks falling foul of its biggest customer, China. In the middle of March China cancelled an order of 600,000 tonnes of soya for delays in the delivery. Recently China has also delayed approval for a new strain of genetically modified soya.

Reports suggest that the approval will be forthcoming, and the delay is merely a technical one associated with the change of government. Nevertheless, the delay has highlighted the power China has to influence Brazilian agricultural policy.