On-going subsidies paid to oil and gas companies are costing the US government billions of dollars in potential revenue and making the transition to low carbon alternatives much more difficult, particularly in the transport sector, which generates 26% of US greenhouse gas emissions.

American fossil fuel companies receive at least US$21 billion (155 yuan billion) a year in subsidies while consumers benefit from some of the lowest fuel taxes in the world.

“If we paid the true cost of gasoline everyone would own an electric vehicle and the US would have a high-speed rail network powered by clean energy,” says Stephen Kretzmann, executive director of Oil Change International, a US-based non-governmental organisation working on energy issues.

Fuel tax failure

The cost of fuels like gasoline vary significantly by country. The average price of gasoline in the US on December 5 was US$0.65 per litre at the pump; Canada $0.88; UK $1.45; and China $0.94. Hong Kong topped the list at $1.94, according to globalpetrolprices.com.

Oil is priced on the global market so price differences are largely the result of national and local taxes. Richer countries tend to tax fuels more than poorer ones. The US, however, is a notable exception to this.

“The US has lower energy taxes than many developing countries from Ethiopia to Turkey,” said Ivetta Gerasimchuk, an energy expert at the International Institute for Sustainable Development (IISD) in Geneva.

This means the US government is foregoing significant tax revenues. In 2015, the US consumed 529 billion litres of gasoline according to the US Energy Information Administration. If that fuel had been taxed at the same rate as Canada, it would have generated an additional US$121 billion in government revenue. In fact, the IMF estimated that the US under-taxed energy use by US$699 billion in 2015 alone, said Gerasimchuk.

Fuel taxes help to offset the additional costs of using fuels that are not included in the price and are instead paid for in other ways by the public. These include, for example, health impacts resulting from air pollution and the cost of adapting to changing climate.

Under-taxation also limits the attractiveness of greener transport alternatives and broader progress toward a low carbon economy. Cheap fuel encourages the sale of larger vehicles and encourages people to drive more because running costs are low; it discourages manufacturers from improving fuel economy standards and from producing new energy vehicles such as electric cars.

The low cost of driving is a factor contributing to urban sprawl and a disincentive for investment in mass transit systems, effectively limiting actions that reduce pollution and CO2 emissions, and locking the US into an unsustainable economic model.

The incoming Trump administration is expected to reduce the pressure on automakers to roughly double vehicle fuel efficiency by 2025, a plan agreed under President Obama in 2011. In fact, according to Reuters, the country’s biggest trade group has asked Trump to roll back the targets, which would remove incentives for companies such as General Motors and Ford to shift consumers away from SUVs toward smaller vehicles and electric vehicles.

The threat of rolling back these targets exposes a clash at the heart of America’s future transport strategy. Federal investment in fossil fuel subsidies is at odds with state and industry targets to reduce dangerous vehicle emissions, improve energy efficiency and push the adoption of electrics vehicles.

Needless production subsidies

While consumers benefit from low fuel taxes, oil production and exploration is subsidised by government. Production subsidies reduce the cost of finding and producing oil and can make the difference between whether production and exploration is economically viable or not.

Estimating US oil and gas subsidies is challenging though because subsidies rarely involve direct cash payments to producers. Instead, they take the form of wide ranging tax breaks for energy companies, interest-free loans, free or low cost access to resources like water and land, and governments assuming the legal risks of exploration and development.

The first US subsidies were put in place nearly 100 years ago to help the nascent oil industry meet the energy needs of a growing nation. Some of the first programmes are still in place today.

In 2009, President Obama, along with other leaders of G20 nations, made a commitment to phase out subsidies. Many countries have started doing so but in the US such action has been consistently blocked by Congress, said Kretzmann.

When oil prices are US$50 a barrel or lower, subsidies can make the difference between whether drilling projects go ahead or not. A forthcoming study of new oil fields in the US finds that state and federal subsidies are a significant factor in increasing oil production when oil prices are low, said Peter Erickson, senior scientist at the Stockholm Environment Institute-US. This support makes it more difficult for the US to reduce CO2 emissions.

At the UN climate talks in Paris last year, nations including the US committed to reduce CO2 emissions and phase out fossil fuels. A report by Oil Change International released in September suggested there is sufficient carbon in the world’s working coal mines and oil and gas fields to push global warming beyond 2C if burned. Other reports argue that the significant unworked fossil fuel reserves claimed by companies must remain unburned.

The world doesn’t need new sources of fossil fuels, said Peter Wooders of Global Subsidies Initiative (GSI) in Geneva. Continued US subsidies for hydraulic fracking make no sense because it’s a mature technology, creates few new jobs, and has major impacts on the environment and local communities. The oil industry is capital intensive but employs relatively few people despite claims by politicians, said Wooders.

Targeted subsidies

To curb emissions from the US transport sector government must remove US$21 billion in subsidies for oil production and exploration, increase fuel taxes for consumers, and ensure that subsidies are targeted specifically at sustainable transport options.

“From a climate perspective there’s absolutely no choice but to move rapidly to electric vehicles while low-emission mass transit systems are being built,” said Wooders.

Targeting subsidies at technologies that can help reduce emissions works. Solar technology offers a good example of how support from governments has helped to massively reduce the cost of solar panels over the past 20 years.

Subsidies for electric vehicles can function in much the same way, helping to reduce costs through technology learning and mass production. Currently, US support from all levels of government averages US$8,000-8,500 per new vehicle. China’s subsidies are closer to $10,000. An estimated 130,000 new EVs will be sold in the US this year amounting to a US$1.1 billion subsidy. However, this is just 5% of what the fossil energy sector receives.

Removing fossil fuel subsidies and taxing fuels to disincentivise vehicle use can encourage Americans to adopt more sustainable forms of transportation. German citizens are five times more likely to use public transit, and not just because their mass transit systems are much better. The biggest reason, according to a study by two US transportation experts, is that they pay higher vehicle fuel and operating costs.

They conclude that governments must put in place transportation policies that restrict vehicle use and make it more expensive. Otherwise, “American public transport is doomed to remain a marginal means of transport, used mainly by those who have no other choice.”

Prospects for change

Although president-elect Donald Trump has promised a massive investment in US infrastructure, it’s unlikely that this will be targeted at sustainable transport alternatives such as high-speed rail, said Ben Schreiber, climate and energy program director at Friends of the Earth US.

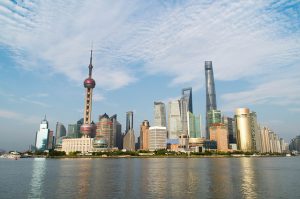

Unlike China and a number of EU countries, the US has no high-speed rail. The fastest train is the Acela Express from Boston to Washington that averages 100 km/hour. High-speed rail in Germany, France, Japan and China are more than twice as fast.

Trump recently nominated former Labor Secretary Elaine Chao to head the Department of Transportation. Chao was “a disaster as Labor Secretary” and did nothing to improve worker safety while undermining the role of unions, said Schreiber.

Although Chao’s priorities are difficult to predict, she is likely to favour deregulation and privatisation, including the sale of public assets and the imposition of tolls on roads and bridges. Such a move could disincentivise vehicle usage. However, Chao’s expected focus on “building new roads and bridges as part of infrastructure spending would be a move in the wrong direction,” said Schreiber.

Perhaps of greater concern is Trump’s denial of climate change and his public support for fossil fuel industries such as coal production that have been hit hard by job losses. This suggests that reducing fossil fuel subsidies and supporting greener transport options will not be a priority for the new administration.

Nonetheless, demand for electric vehicles is expected to remain high. Tesla’s Model S is the world’s best-selling luxury car. The upstart US automaker received deposits of US$1000 from nearly 400,000 people this year to purchase its new lower-priced Model 3, which has a 250 kilometre range.

More than 80% of Americans dislike the idea that oil companies get billions in taxpayer subsidies, says Kretzmann. However, a number of members of the US Congress depend on contributions from fossil fuel companies for re-election. The American people will have to hold their representatives to account to bring an end to such wasteful subsidies.

The Stockholm Environmental Institute will produce a major study of subsidies to US oil producers in January 2017.