China’s overseas investments in renewable energy now span the globe. And with China at the helm, the BRICS, which include Brazil, Russia, India, China and South Africa, have emerged as a major force for global green energy investment.

In 2016, the BRICS constituted 38% of the world’s installed renewable energy capacity, almost double their 22.5% share of global GDP in 2015.

China has been the main driver of this clean energy investment. It represents two-thirds of the BRICS renewable energy capacity and a quarter of the global total. However, Brazil and India are also on the ascent, each contributing approximately 5% of the global total in 2016.

Scaling up investment

Looking ahead, the BRICS countries are projected to increase their share of global renewable energy. Their national targets would raise the total amount of installed renewable capacity across the five countries to 1,251 gigawatts between 2020-2030.

But meeting these targets will require enormous investment.

China is already the world’s largest investor in renewables, providing US$78.3 billion (516 billion yuan) in 2016, down about a quarter from the US$102.9 billion (678 billion yuan) it invested in 2015. Despite the dip, China still accounts for over a third of global investment in renewables.

However, the BRICS countries, excluding South Africa, must invest even more if they are to meet their own renewable energy targets. In 2015, the BRICS faced a shortfall of US$51 billion (336 billion yuan) in renewables financing, according to a recent study by the Institute for Energy Economics and Financial Analysis (IEEFA).

Can the NDB help?

Launched by the BRICS in 2015, the New Development Bank (NDB) is seeking to bridge this gap. Six of the bank’s seven loans – 78% of the total financing to date – have gone to clean energy projects within the BRICS countries.

“The New Development Bank, allied with the Asian Infrastructure Investment Bank, has made a clear and significant commitment to accelerating renewables investment across the developing world,” commented Tim Buckley, co-author of the aforementioned IEEFA study.

As the NDB scales up its portfolio in the coming years, its president has committed approximately 60% of its loans to renewable energy. This pledge is notable because other multilateral development banks have apportioned much smaller shares of funding to renewables. For example, 25.6% of World Bank financing was directed at renewable energy projects from 2008-2014. However, the NDB is still operating at a much smaller scale than other development banks.

China pushing renewables investment

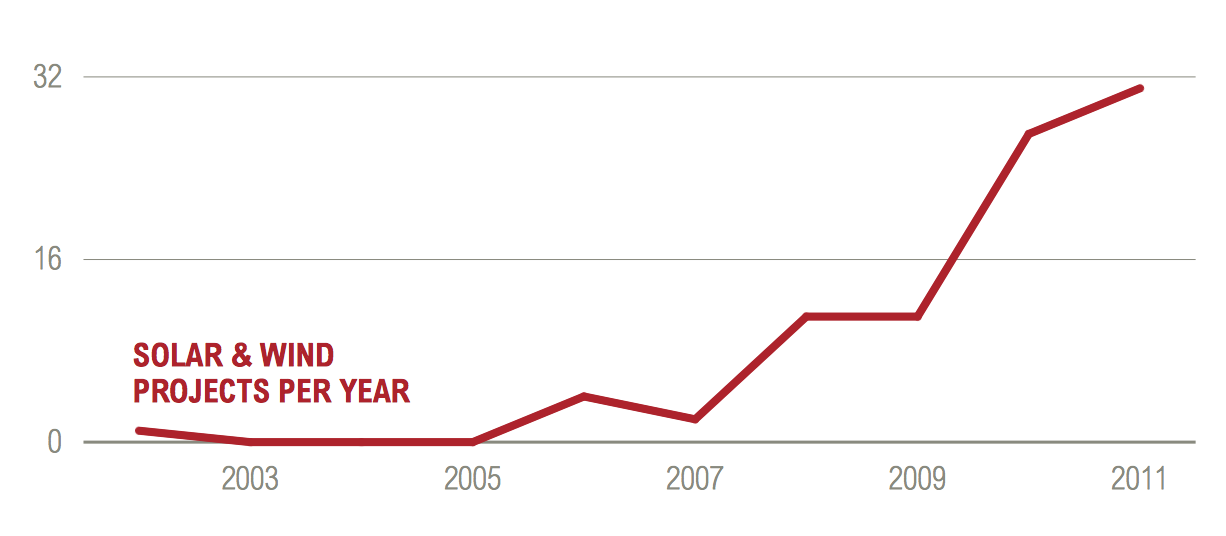

Following the boom in domestic green energy, Chinese companies and institutions are looking to expand overseas. From 2002-2012, Chinese companies made at least 124 solar and wind power investments in 33 countries, according to the World Resources Institute.

“The Chinese government has been encouraging Chinese companies to “go out” and will continue to do so,” said Peng Peng, head of policy consulting at the China Renewable Energy Industry Association. He added: “With this policy support and the improvement in Chinese manufacturing standards, I believe more and more Chinese companies – both state-owned and private – will invest in overseas renewable projects.”

In 2016, China made 11 foreign investment decisions in renewables exceeding US$1 billion, and worth a total of US$32 billion – 60% more than in 2015. Four of China’s investments between 2015 and 2016 were in Brazil. This included the largest deal, the acquisition of a controlling stake in CPFL Energia SA, which was valued at US$13 billion.

In 2016, China was also the fifth-largest source country for renewable energy investments into other emerging markets, totalling US$19.7 billion since 2005. According to the Financial Times, all the BRICS countries except Russia were among the top destinations for Chinese cross-border renewable energy investment in 2015.

As for on-the-ground project development in BRICS countries, Chinese activity in South Africa has been heating up. In the wind power sector, China Longyuan Power Group Corporation won two bids to construct wind farms totalling 244 megawatts in De Aar. In 2015, Goldwind won a contract to supply its first wind farm in South Africa, the 120 megawatt Golden Valley project.

Although Russia has seen comparatively little Chinese investment in renewables, in 2016, State Grid Corporation of China announced it would explore the possibility of a North Asia grid interconnector linking China, Russia, Japan, and South Korea. This could facilitate renewable energy delivery and grid balancing.

Equipment manufacturing

China’s manufacturing prowess in the renewables sector has also furthered clean power installations in the BRICS countries. China boasts five of the world’s top six solar module manufacturing firms and five of the top ten wind-turbine manufacturing firms. Notably, China has shifted its export of solar panels from developed to developing countries over the past five years.

In Africa, South Africa is serving as an entry point for Chinese solar manufacturers to operate across the continent. JinkoSolar, the world’s largest solar module producer, dominates the market in South Africa. The company recently built a module manufacturing plant in Cape Town with an annual capacity of 120 megawatts.

India was the top recipient of Chinese solar panels in 2016, accounting for 87% of India’s solar imports from September 2016 to April 2017. But China’s market dominance has not gone unnoticed. In July, India launched an investigation into the alleged dumping of Chinese solar cells in the Indian market, which local manufacturers blame for undercutting domestic production.

“The strategy of only aiming to take up more market share is outdated. Now Chinese companies need to learn how to better capitalise on local resources to reduce cost, improve competitiveness, and avoid trade disputes,” said Qin Haiyan, secretary-general of the Chinese Wind Energy Association.

Looking ahead

While China’s solar panels, wind turbines, and energy investments are greening the globe, the country’s environmental record continues to be tarnished by overseas coal projects. A study by the Global Environmental Institute published earlier this year analysed China’s overseas coal involvement and found that India and Russia were China’s highest and sixth highest destination countries, respectively.

Next week’s BRICS Summit is an opportunity for China and its BRICS partners to celebrate the achievements that have been made in advancing renewable energy. But challenges still remain for the BRICS as they transition to cleaner energy. In particular, China must limit its overseas coal investments to align with the group’s commitment to a low-carbon future.

![A woman pumps up water from a tubewell in West Bengal despite the red cross that signifies that there is an unacceptable level of arsenic in the water [image by Dilip Banerjee]](https://dialogue.earth/content/uploads/2017/09/Woman-at-tubewell-West-Bengal-Image-by-Dilip-Banerjee-1-300x206.jpg)